portfolio-management

Revisiting the continuous-time Mean-Variance (MV) Portfolio Optimization problem, we model the market dynamics with a jump-diffusion process and apply Reinforcement Learning (RL) techniques to facilitate informed exploration within the control space. We recognize the time-inconsistency of the MV problem and adopt the time-inconsistent control (TIC) approach to analytically solve for an exploratory equilibrium investment policy, which is a Gaussian distribution centered on the equilibrium control of the classical MV problem. Our approach accounts for time-inconsistent preferences and actions, and our equilibrium policy is the best option an investor can take at any given time during the investment period. Moreover, we leverage the martingale properties of the equilibrium policy, design a RL model, and propose an Actor-Critic RL algorithm. All of our RL model parameters converge to the corresponding true values in a simulation study. Our numerical study on 24 years of real market data shows that the proposed RL model is profitable in 13 out of 14 tests, demonstrating its practical applicability in real world investment.

In this paper, we show that interventionally robust optimization problems in causal models are continuous under the G-causal Wasserstein distance, but may be discontinuous under the standard Wasserstein distance. This highlights the importance of using generative models that respect the causal structure when augmenting data for such tasks. To this end, we propose a new normalizing flow architecture that satisfies a universal approximation property for causal structural models and can be efficiently trained to minimize the G-causal Wasserstein distance. Empirically, we demonstrate that our model outperforms standard (non-causal) generative models in data augmentation for causal regression and mean-variance portfolio optimization in causal factor models.

This paper presents a Multi Agent Bitcoin Trading system that utilizes Large Language Models (LLMs) for alpha generation and portfolio management in the cryptocurrencies market. Unlike equities, cryptocurrencies exhibit extreme volatility and are heavily influenced by rapidly shifting market sentiments and regulatory announcements, making them difficult to model using static regression models or neural networks trained solely on historical data. The proposed framework overcomes this by structuring LLMs into specialised agents for technical analysis, sentiment evaluation, decision-making, and performance reflection. The agents improve over time via a novel verbal feedback mechanism where a Reflect agent provides daily and weekly natural-language critiques of trading decisions. These textual evaluations are then injected into future prompts of the agents, allowing them to adjust allocation logic without weight updates or finetuning. Back-testing on Bitcoin price data from July 2024 to April 2025 shows consistent outperformance across market regimes: the Quantitative agent delivered over 30\% higher returns in bullish phases and 15\% overall gains versus buy-and-hold, while the sentiment-driven agent turned sideways markets from a small loss into a gain of over 100\%. Adding weekly feedback further improved total performance by 31\% and reduced bearish losses by 10\%. The results demonstrate that verbal feedback represents a new, scalable, and low-cost approach of tuning LLMs for financial goals.

The financial domain poses unique challenges for knowledge graph (KG) construction at scale due to the complexity and regulatory nature of financial documents. Despite the critical importance of structured financial knowledge, the field lacks large-scale, open-source datasets capturing rich semantic relationships from corporate disclosures. We introduce an open-source, large-scale financial knowledge graph dataset built from the latest annual SEC 10-K filings of all S and P 100 companies - a comprehensive resource designed to catalyze research in financial AI. We propose a robust and generalizable knowledge graph (KG) construction framework that integrates intelligent document parsing, table-aware chunking, and schema-guided iterative extraction with a reflection-driven feedback loop. Our system incorporates a comprehensive evaluation pipeline, combining rule-based checks, statistical validation, and LLM-as-a-Judge assessments to holistically measure extraction quality. We support three extraction modes - single-pass, multi-pass, and reflection-agent-based - allowing flexible trade-offs between efficiency, accuracy, and reliability based on user requirements. Empirical evaluations demonstrate that the reflection-agent-based mode consistently achieves the best balance, attaining a 64.8 percent compliance score against all rule-based policies (CheckRules) and outperforming baseline methods (single-pass and multi-pass) across key metrics such as precision, comprehensiveness, and relevance in LLM-guided evaluations.

This paper models strategic interactions among a large population of fund managers whose benchmark constraints incorporate both an exogenous market index and the population's average wealth, framing it as a Mean Field Game. It establishes the existence of a Mean Field Equilibrium and analytically characterizes optimal investment and capital injection strategies using techniques like dual transforms and reflected diffusion processes.

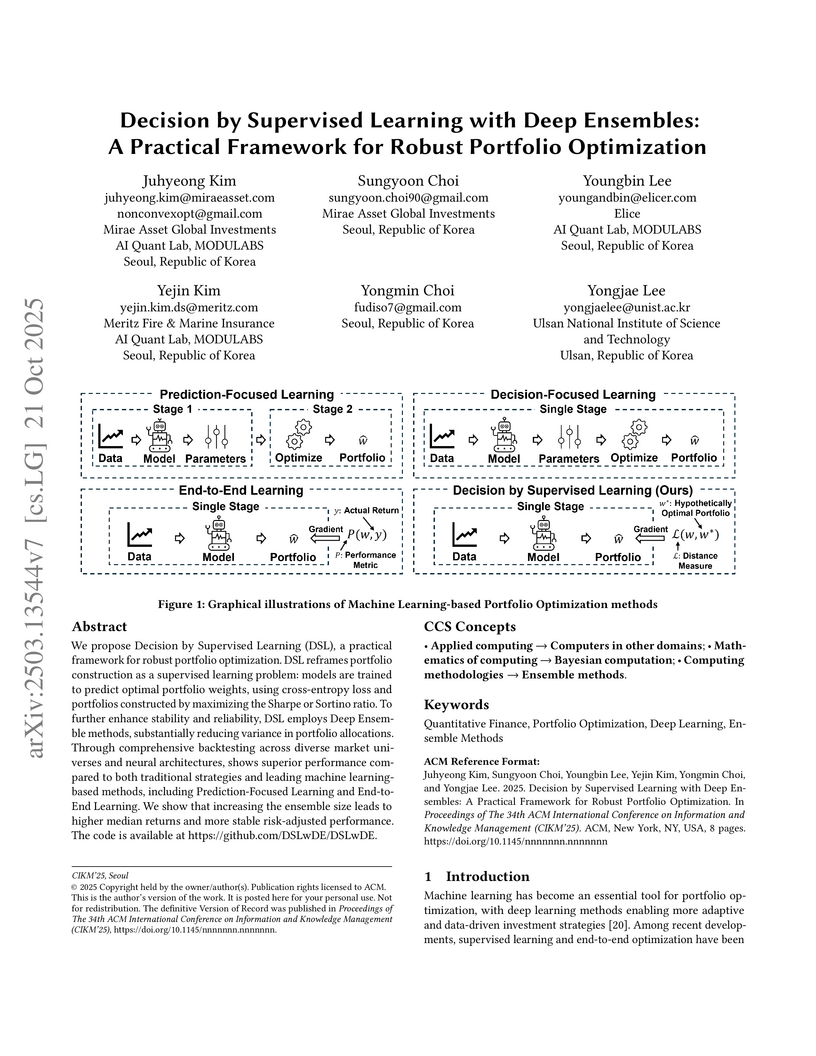

We propose Decision by Supervised Learning (DSL), a practical framework for robust portfolio optimization. DSL reframes portfolio construction as a supervised learning problem: models are trained to predict optimal portfolio weights, using cross-entropy loss and portfolios constructed by maximizing the Sharpe or Sortino ratio. To further enhance stability and reliability, DSL employs Deep Ensemble methods, substantially reducing variance in portfolio allocations. Through comprehensive backtesting across diverse market universes and neural architectures, shows superior performance compared to both traditional strategies and leading machine learning-based methods, including Prediction-Focused Learning and End-to-End Learning. We show that increasing the ensemble size leads to higher median returns and more stable risk-adjusted performance. The code is available at this https URL.

This research introduces a novel two-step modified k-means clustering algorithm that leverages comprehensive macroeconomic data for robust, probabilistic economic regime detection. The method significantly enhances tactical asset allocation performance across various forecasting and portfolio optimization models, yielding superior risk-adjusted returns and improved interpretability.

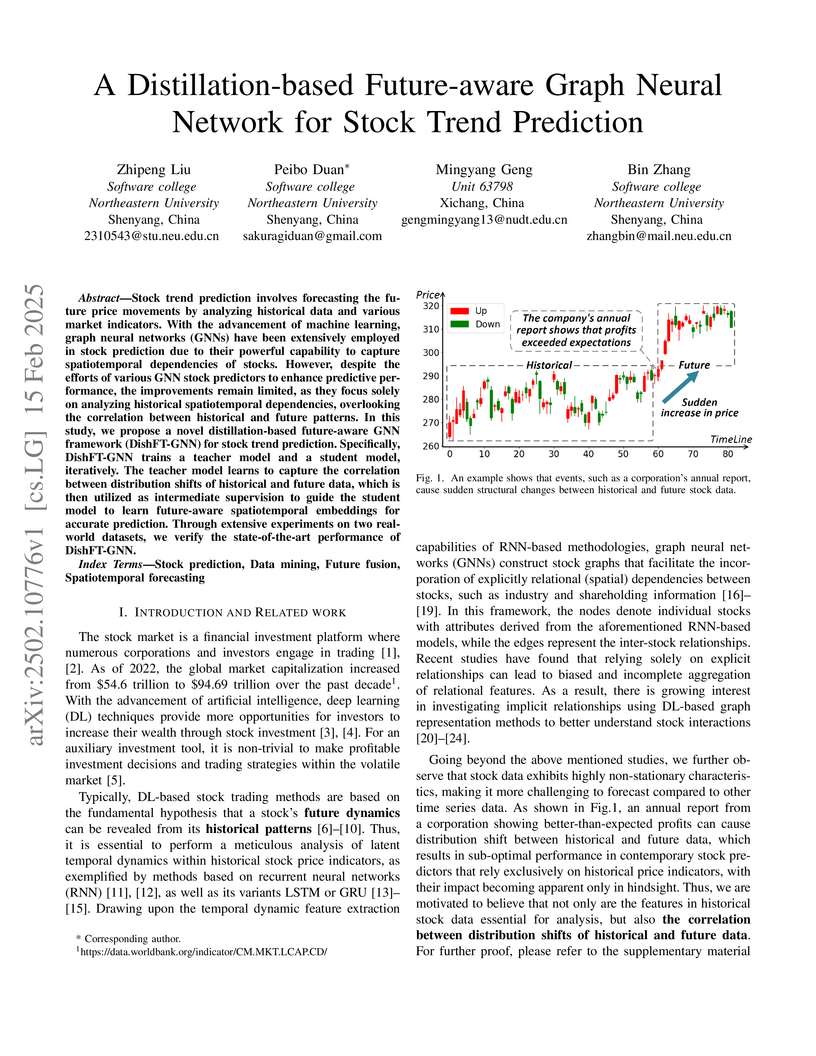

Stock trend prediction involves forecasting the future price movements by

analyzing historical data and various market indicators. With the advancement

of machine learning, graph neural networks (GNNs) have been extensively

employed in stock prediction due to their powerful capability to capture

spatiotemporal dependencies of stocks. However, despite the efforts of various

GNN stock predictors to enhance predictive performance, the improvements remain

limited, as they focus solely on analyzing historical spatiotemporal

dependencies, overlooking the correlation between historical and future

patterns. In this study, we propose a novel distillation-based future-aware GNN

framework (DishFT-GNN) for stock trend prediction. Specifically, DishFT-GNN

trains a teacher model and a student model, iteratively. The teacher model

learns to capture the correlation between distribution shifts of historical and

future data, which is then utilized as intermediate supervision to guide the

student model to learn future-aware spatiotemporal embeddings for accurate

prediction. Through extensive experiments on two real-world datasets, we verify

the state-of-the-art performance of DishFT-GNN.

Artificial intelligence is transforming financial investment decision-making

frameworks, with deep reinforcement learning demonstrating substantial

potential in robo-advisory applications. This paper addresses the limitations

of traditional portfolio optimization methods in dynamic asset weight

adjustment through the development of a deep reinforcement learning-based

dynamic optimization model grounded in practical trading processes. The

research advances two key innovations: first, the introduction of a novel

Sharpe ratio reward function engineered for Actor-Critic deep reinforcement

learning algorithms, which ensures stable convergence during training while

consistently achieving positive average Sharpe ratios; second, the development

of an innovative comprehensive approach to portfolio optimization utilizing

deep reinforcement learning, which significantly enhances model optimization

capability through the integration of random sampling strategies during

training with image-based deep neural network architectures for

multi-dimensional financial time series data processing, average Sharpe ratio

reward functions, and deep reinforcement learning algorithms. The empirical

analysis validates the model using randomly selected constituent stocks from

the CSI 300 Index, benchmarking against established financial econometric

optimization models. Backtesting results demonstrate the model's efficacy in

optimizing portfolio allocation and mitigating investment risk, yielding

superior comprehensive performance metrics.

12 Dec 2024

Traditional methods employed in matrix volatility forecasting often overlook the inherent Riemannian manifold structure of symmetric positive definite matrices, treating them as elements of Euclidean space, which can lead to suboptimal predictive performance. Moreover, they often struggle to handle high-dimensional matrices. In this paper, we propose a novel approach for forecasting realized covariance matrices of asset returns using a Riemannian-geometry-aware deep learning framework. In this way, we account for the geometric properties of the covariance matrices, including possible non-linear dynamics and efficient handling of high-dimensionality. Moreover, building upon a Fréchet sample mean of realized covariance matrices, we are able to extend the HAR model to the matrix-variate. We demonstrate the efficacy of our approach using daily realized covariance matrices for the 50 most capitalized companies in the S&P 500 index, showing that our method outperforms traditional approaches in terms of predictive accuracy.

Data-driven decision-making processes increasingly utilize end-to-end

learnable deep neural networks to render final decisions. Sometimes, the output

of the forward functions in certain layers is determined by the solutions to

mathematical optimization problems, leading to the emergence of differentiable

optimization layers that permit gradient back-propagation. However, real-world

scenarios often involve large-scale datasets and numerous constraints,

presenting significant challenges. Current methods for differentiating

optimization problems typically rely on implicit differentiation, which

necessitates costly computations on the Jacobian matrices, resulting in low

efficiency. In this paper, we introduce BPQP, a differentiable convex

optimization framework designed for efficient end-to-end learning. To enhance

efficiency, we reformulate the backward pass as a simplified and decoupled

quadratic programming problem by leveraging the structural properties of the

KKT matrix. This reformulation enables the use of first-order optimization

algorithms in calculating the backward pass gradients, allowing our framework

to potentially utilize any state-of-the-art solver. As solver technologies

evolve, BPQP can continuously adapt and improve its efficiency. Extensive

experiments on both simulated and real-world datasets demonstrate that BPQP

achieves a significant improvement in efficiency--typically an order of

magnitude faster in overall execution time compared to other differentiable

optimization layers. Our results not only highlight the efficiency gains of

BPQP but also underscore its superiority over differentiable optimization layer

baselines.

This paper introduces a novel approach to optimizing portfolio rebalancing by integrating Graph Neural Networks (GNNs) for predicting transaction costs and Dijkstra's algorithm for identifying cost-efficient rebalancing paths. Using historical stock data from prominent technology firms, the GNN is trained to forecast future transaction costs, which are then applied as edge weights in a financial asset graph. Dijkstra's algorithm is used to find the least costly path for reallocating capital between assets. Empirical results show that this hybrid approach significantly reduces transaction costs, offering a powerful tool for portfolio managers, especially in high-frequency trading environments. This methodology demonstrates the potential of combining advanced machine learning techniques with classical optimization algorithms to improve financial decision-making processes. Future research will explore expanding the asset universe and incorporating reinforcement learning for continuous portfolio optimization.

Researchers from The Hong Kong University of Science and Technology and Peking University developed a three-stage framework leveraging Large Language Models (LLMs) and a multi-agent system to automate quantitative investment strategy discovery and portfolio management. The system achieved a 53.17% cumulative return on the SSE50 index, dramatically outperforming the benchmark's -11.73% over the same period, and demonstrated robust, adaptive performance across diverse market conditions.

Researchers at the Oxford-Man Institute, University of Oxford, developed an end-to-end deep learning framework for options trading that directly optimizes for risk-adjusted performance from raw market data. This framework generates trading signals for delta-neutral straddles, achieving Sharpe ratios approximately double those of traditional rules-based benchmarks and effectively managing transaction costs through regularization.

Researchers developed "loss-versus-rebalancing" (LVR), a novel metric quantifying adverse selection costs for Automated Market Maker liquidity providers, offering a continuous-time framework that robustly tracks real-world LP performance after hedging market risk. This work from Columbia University and the University of Chicago provides a superior benchmark for AMM analysis and guides future protocol design.

More and more stock trading strategies are constructed using deep

reinforcement learning (DRL) algorithms, but DRL methods originally widely used

in the gaming community are not directly adaptable to financial data with low

signal-to-noise ratios and unevenness, and thus suffer from performance

shortcomings. In this paper, to capture the hidden information, we propose a

DRL based stock trading system using cascaded LSTM, which first uses LSTM to

extract the time-series features from stock daily data, and then the features

extracted are fed to the agent for training, while the strategy functions in

reinforcement learning also use another LSTM for training. Experiments in DJI

in the US market and SSE50 in the Chinese stock market show that our model

outperforms previous baseline models in terms of cumulative returns and Sharp

ratio, and this advantage is more significant in the Chinese stock market, a

merging market. It indicates that our proposed method is a promising way to

build a automated stock trading system.

Recent advances in neural-network architecture allow for seamless integration

of convex optimization problems as differentiable layers in an end-to-end

trainable neural network. Integrating medium and large scale quadratic programs

into a deep neural network architecture, however, is challenging as solving

quadratic programs exactly by interior-point methods has worst-case cubic

complexity in the number of variables. In this paper, we present an alternative

network layer architecture based on the alternating direction method of

multipliers (ADMM) that is capable of scaling to problems with a moderately

large number of variables. Backward differentiation is performed by implicit

differentiation of the residual map of a modified fixed-point iteration.

Simulated results demonstrate the computational advantage of the ADMM layer,

which for medium scaled problems is approximately an order of magnitude faster

than the OptNet quadratic programming layer. Furthermore, our novel

backward-pass routine is efficient, from both a memory and computation

standpoint, in comparison to the standard approach based on unrolled

differentiation or implicit differentiation of the KKT optimality conditions.

We conclude with examples from portfolio optimization in the integrated

prediction and optimization paradigm.

The FT-CE-RNN model from Ecole Polytechnique and Exoduspoint Capital Management predicts short-term stock movements using financial news headlines by combining fine-tuned BERT contextualized embeddings with a recurrent neural network. This approach demonstrates improved accuracy on market-moving news and yields profitable simulated trading strategies with annualized returns up to 19.72%.

Uniswap is a decentralized exchange (DEX) and was first launched on November

2, 2018 on the Ethereum mainnet [1] and is part of an Ecosystem of products in

Decentralized Finance (DeFi). It replaces a traditional order book type of

trading common on centralized exchanges (CEX) with a deterministic model that

swaps currencies (or tokens/assets) along a fixed price function determined by

the amount of currencies supplied by the liquidity providers. Liquidity

providers can be regarded as investors in the decentralized exchange and earn

fixed commissions per trade. They lock up funds in liquidity pools for distinct

pairs of currencies allowing market participants to swap them using the fixed

price function. Liquidity providers take on market risk as a liquidity provider

in exchange for earning commissions on each trade. Here we analyze the risk

profile of a liquidity provider and the so called impermanent (unrealized) loss

in particular. We provide an improved version of the commonly denoted

impermanent loss function for Uniswap v2 on the semi-infinite domain. The

differences between Uniswap v2 and v3 are also discussed.

Researchers at the Oxford-Man Institute of Quantitative Finance developed a framework using Learning to Rank (LTR) algorithms to build cross-sectional systematic trading strategies. This approach significantly improved asset selection and portfolio performance, yielding up to a threefold increase in Sharpe Ratios compared to traditional and standard machine learning methods.

There are no more papers matching your filters at the moment.